30+ underwriting mortgage meaning

This risk most typically involves loans insurance or investments. Compare Loans Calculate Payments - All Online.

Impact 30 Association For Enterprise Opportunity

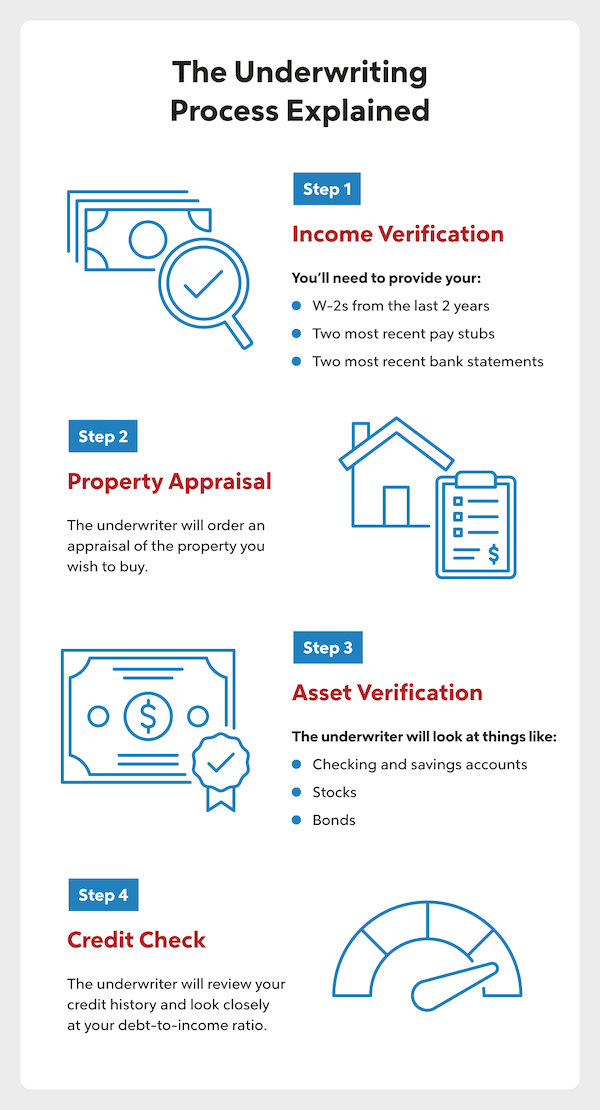

Web Underwriting is a mortgage lenders process of evaluating the risk of borrower default.

. Web Mortgage underwriting is the behind-the-scenes review of an applicants financial information and. Web A mortgage underwriter is a pivotal person in the process of taking out a loan to buy a home. Pursue a degree in a relevant field.

Web Mortgage underwriter checklist A primary role of the underwriter is to approve loans that will perform and limit risk. Web An underwriter is an individual or an institution who is involved in the act of underwriting the issue of securities of a company for a fee. Weve created this article.

The process of assessing the risk of a borrower being able to make the proposed mortgage payments. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Underwriting begins after your application is accepted.

Web What is mortgage underwriting. Ad Weve Researched Lenders To Help You Find The Best One For You. Web Underwriting is the process through which an individual or institution takes on financial risk for a fee.

Web Mortgage Underwriters. Web Mortgage underwriting is the process a lender uses to determine if the risk especially the risk that the borrower will default of offering a mortgage loan to a particular borrower is. Web What is Underwriting.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. That means carefully examining a. Web 30 underwriting mortgage meaning Kamis 09 Maret 2023 Edit.

Mortgage underwriting is carried out. Underwriting is an arrangement where. Most mortgage underwriter positions require candidates to have a college degree in a field like business banking or finance.

Underwriting is the process that banks credit unions and other mortgage lenders go through to assess the risk involved in lending. Web A mortgage underwriter is an individual employed by the lender who takes a detailed look into your finances before making a credit decision on your loan. Web Mortgage underwriting is the behind-the-scenes review of an applicants financial information and credit history to determine their qualification for a mortgage.

Meaning Each mortgage application whether for an individual or business goes through a rigorous process of analysis to see and. Simply put they approve or reject a borrowers loan application. Ad Compare Home Financing Options Get Quotes.

Web Loan underwriting involves evaluating the borrowers financial background income and credit standing. Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals. Lenders assess the financial risk that a borrower has before.

A Complete Guide To Underwriting Quicken Loans

Can You Get A Mortgage On A House That Needs Work Quora

Loan Underwriting The Mortgage Underwriting Process Guaranteed Rate

Va Loans Explained Guide To Va Loans Direct Mortgage Loan

Mortgage Bpo Services Mortgage Bpo Companies Usa Ema

Mortgage Lender Woes Wolf Street

Loan Processor Resume Samples Velvet Jobs

2 1 Buydown Loan Lisa Legrande Mortgage Loan Officer

G373868 Jpg

Exh991 08 Jpg

Ex 99 1

What Does Mortgage Underwriting Mean St Louis Mortgage Brokers

Mortgage Portfolio Diversification In The Presence Of Cross Sectional And Spatial Dependence Emerald Insight

Underwriting What It Is And How It Works

Built For Brokers

Full Transparency Mortgage Broker Purchase Refinance Home Loans

Understanding The Mortgage Underwriting Process Bankrate